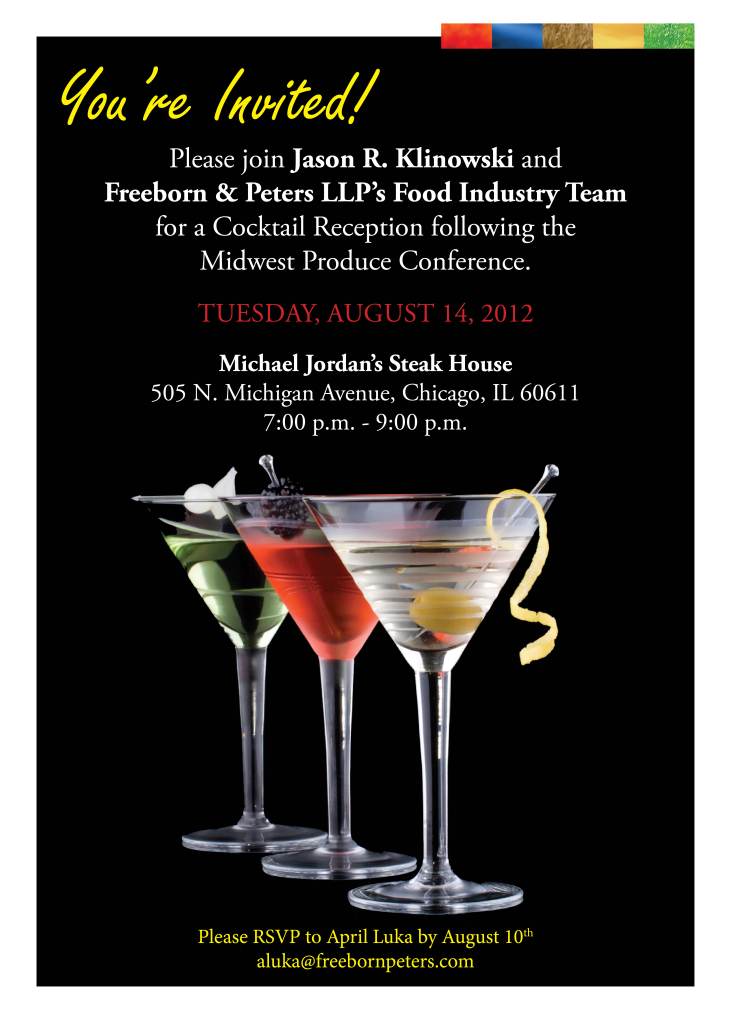

I wanted to personally thank everyone who came out to Michael Jordan’s Steak House and joined Freeborn & Peters LLP’s Food Industry Team for a cocktail reception following the Midwest Produce Conference + Expo. For those of you who could not join us, please look for us at the upcoming PMA Fresh Summit Convention this October!

Tag Archives: FDA lawyer

FSMA Update: 2013 Fee Schedule Features Reduced Rates!

On July 31, 2012, the FDA announced its fee structure for rates to be assessed under the Food Safety Modernization Act in 2013. The rates for 2013 are $221.00 per hour if no foreign travel is required and $289.00 per hour if foreign travel is required. These new rates will be effective from October 1, 2012 through September 30, 2013, which is when the next fiscal year’s fee schedule will be published.

On July 31, 2012, the FDA announced its fee structure for rates to be assessed under the Food Safety Modernization Act in 2013. The rates for 2013 are $221.00 per hour if no foreign travel is required and $289.00 per hour if foreign travel is required. These new rates will be effective from October 1, 2012 through September 30, 2013, which is when the next fiscal year’s fee schedule will be published.

The good news is that the 2013 rates are lower than the 2012 rates, which were $224.00 per hour is no foreign travel is required and $325.00 per hour if foreign travel is required. Perhaps the rate reduction in 2013 is a sign that the FDA is attempting to implement FSMA in light of the known operational realities and pain tolerances for administrative fees that exist in the food industry.

With that said, it is important to remember that FSMA’s fee structure represents hourly rates charged by each FDA inspector participating any type of billable activity related to a given case. As a reminder, billable activities include conducting the reinspection at the facility, making preparations and arrangements for the reinspection, traveling to and from the facility, analyzing records, analyzing samples, preparing reports or examining labels and performing any other activity deemed necessary to determine compliance with the regulation or statute found to be violated in the initial inspection. Other billable activities include conducting recall audit checks, reviewing periodic status reports, analyzing the status reports and the results of the audit checks, conducting inspections, traveling to and from locations, and monitoring product disposition. Simply put, even with a reduced fee structure, FSMA related fees can add up quickly and significantly impact businesses.

Will the FDA charge and collect fees under FSMA in 2013?

Because FDA recognizes that for some small businesses the full cost recovery of FDA reinspection or recall oversight could impose severe economic hardship, FDA intends to consider reducing certain fees for those firms. FDA is currently developing a guidance document to outline the process through which firms may request such a reduction of fees. FDA does not intend to issue invoices for reinspection or recall order fees until this guidance document has been published.

Who will be affected by these fees?

Only those parties in the food and feed industry whose non-compliance results in the following activities:

- Facility reinspections – follow-up inspections conducted by FDA subsequent to a previous facility inspection that identified noncompliance materially related to a food safety requirement of the Federal Food, Drug, and Cosmetic Act (the Act). The reinspection must be conducted specifically to determine that compliance has been achieved.

- Recalls – food recall activities performed by FDA that are associated with a recall order with which a responsible party has not complied.

- Importer reinspections — follow-up inspections of a food offered for import conducted by FDA subsequent to a previous inspection that identified noncompliance materially related to a food safety requirement of the Act. The reinspection must be conducted specifically to determine that compliance has been achieved. As discussed in F.2.2., these fees will not be assessed until the agency has resolved issues associated with these fees and the public has been notified by the agency.

Can small businesses have their fees waived?

The FY 2013 fee schedule does not contain any reduced fee rate for small business. However, FDA does not intend to issue invoices for reinspection or recall order fees until a guidance document to outline the process through which firms may request a reduction of fees has been published. Once published, invoices will be issued and firms can apply for reductions as outlined in the guidance.

How does FDA plan to charge these fees?

For facility reinspection fees, FDA will invoice the responsible party for each domestic facility and the United States Agent for each foreign facility for the direct hours, including travel, spent to perform the reinspection at the appropriate hourly rate. For recall order fees, FDA will invoice the responsible party for each domestic facility or an importer who does not comply with a recall order under sections 423 or 412 of the Act for the hours spent to cover food recall activities associated with such order. For importer reinspection fees, FDA will invoice the importer for the direct hours spent to perform the reinspection including travel. Detailed payment information will be included in the invoice.

Which fiscal year rate will be used and when?

The fiscal year in which the reinspection occurs dictates the fee rate to be applied. For example, if a reinspection was conducted in September, 2012 and the invoice was issued in October, 2012, the fee rate to be applied would be the FY 2012 rate. The invoice clearly itemizes the fiscal year, hours and rate used to calculate the total invoice amount.

How long does the responsible party have to pay the fees?

Payment must be made within 90 days of the invoice date.

What happens if the responsible party or U.S. Agent does not pay?

Any fee that is not paid within 30 days after it is due shall be treated as a claim of the United States government subject to provisions of subchapter II of Chapter 37 of Title 31, United States Code.

Jason Klinowski Presents at the 3rd Advanced Summit on Food Safety Regulatory Compliance

Recently, I had the privilege of speaking at the American Conference Institute’s 3rd Advanced Summit on Food Safety Regulatory Compliance, which was held in Chicago, Illinois on June 26-27 2012. My presentation discussed: “How to Prepare and Implement Effective Remediation and Corrective Action Plans Post-Inspection.” Notable conference attendees included counsel and/or representatives from ConAgra Foods, H.J. Heinz Company, J.M. Smucker Company, Whole Foods Market and others. Freeborn & Peters LLP was a proud sponsor of this event.

Recently, I had the privilege of speaking at the American Conference Institute’s 3rd Advanced Summit on Food Safety Regulatory Compliance, which was held in Chicago, Illinois on June 26-27 2012. My presentation discussed: “How to Prepare and Implement Effective Remediation and Corrective Action Plans Post-Inspection.” Notable conference attendees included counsel and/or representatives from ConAgra Foods, H.J. Heinz Company, J.M. Smucker Company, Whole Foods Market and others. Freeborn & Peters LLP was a proud sponsor of this event.

My presentation provided a practitioner’s point of view (as outside general counsel to numerous food companies) on how to prepare a proper response to a FDA 483 Report of Investigation, which including drafting tips, best practices and response strategies. Following this same format, I also discussed how to prepare effective corrective action plans and reconditioning plans.

For those of you who may be interested, here is a link to my presentation:

FSMA Update: FDA Releases New Information Related to Food Facility Registration

The FDA recently published information answering three frequently asked questions:

The FDA recently published information answering three frequently asked questions:

QUESTION: What form do I use to renew a food facility registration?

ANSWER: FDA Form 3537.

Registrants must use Form 3537 to register, update, or renew a registration. Form 3537 is being updated to meet registration renewal needs. The next registration renewal cycle begins October 1, 2012. Facilities may register online via the Internet at www.fda.gov/furls, which operates during business hours from 7:00 am to 11:00 pm U.S. Eastern Standard Time.

QUESTION: Am I required to renew a food facility registration online?

ANSWER: No! Registrants can renew food facility registrations online or submit the paper Form 3537 by mail or fax. A business with multiple facilities may also register on a CD-ROM by mail. FDA encourages online registration as the least costly, quickest, and most efficient means for food facility registration. With online registration, a food facility must enter all of the required information before the system will accept the submission. After all required information has been entered, a registrant will receive confirmation of registration and a registration number. Paper registration is a more costly and less efficient process to supply FDA with registration information and to provide food facilities with their registration numbers. Further, paper registration may have a higher number of errors or omissions on the form, which may require additional time to complete the registration process.

QUESTION: Why wait until October 1, 2012 to start the registration renewal process?

ANSWER: Because you will be required to do it again between Oct. 1 and Dec. 31, 2012. The FDA Food Safety Modernization Act (FSMA) mandates that all food facilities that are required to register must renew their registrations every other year during the period beginning on October 1st and ending on December 31st of each even-numbered year. The first registration renewal cycle will occur from October 1 to December 31, 2012.

As always, more information may be found at: Food Safety Modernization Act – FAQ Page

Please keep in mind that the FDA does not provide answers to questions of registration strategy, information disclosure and impact of registration choices on frequency of inspections and the classification of a food facility as high risk or non-high risk. These are ALL very important issues that need to be addressed.

FSMA Update: FDA Releases New Information Related to Food Facility Registration

The FDA recently published information answering two frequently asked questions:

QUESTION: Does the Food Safety Modernization Act require a food facility to submit additional information to FDA in order for the facility to receive a food facility registration number?

ANSWER: Yes! Section 102 of FSMA amends section 415(a)(2) of the Federal Food, Drug, and Cosmetic Act by requiring food facilities to submit registrations to FDA containing additional information. Specifically, registrations are required to contain the e-mail address for the contact person of the facility, or for a foreign facility, the email address of the United States agent for the facility, and an assurance that FDA will be permitted to inspect the facility at the times and in the manner permitted by the FD&C Act. Additionally, if determined necessary by FDA, registrations are required to contain information regarding other applicable food categories, as determined appropriate by FDA, for foods manufactured/processed, packed, or held at registering facilities.

QUESTION: Will food facilities already registered with FDA under section 415 of the FD&C Act be required to renew their registrations during the October 1 – December 2012 registration renewal period?

ANSWER: Yes! All facilities that are required to register must renew their registrations during the period beginning on October 1 and ending on December 31 of each even-numbered year. The first registration renewal cycle will be held from October 1 to December 31, 2012. Registrants are required to submit registrations to FDA containing the new information added by section 102 of FSMA. As new requirements and guidance go into effect related to facility registration renewal, FDA will post the information on this FSMA website.

As always, more information may be found at: Food Safety Modernization Act – FAQ Page

Should a Company’s Failure to Comply with Food Safety Programs or Laws be Deemed an Unfair Trade Practice?

The Packer recently reported that the “CaliforniaCantaloupe Advisory Board is establishing the state’s first mandatory food safety program implemented by a commodity board.” Although the actual details are still in the works, Steve Patricio, chairman of the California Cantaloupe Advisory Board, stated that “we have existing assessments and revenue we can convert to food safety” and “there will be an additional assessment, probably as high as two cents a carton.” California Cantaloupe Food Safety Program Article – The Packer

According to the article, the proposed Cantaloupe safety program utilizes USDA inspectors under the supervision of the California Department of Food and Agriculture (“CDFA”). This is important because the CDFA stated that:

“noncompliance with the coming food safety metrics would amount to an unfair trade practice.”

Under California law,

“a marketing order may contain provisions which relate to the prohibition of unfair trade practices. In addition to the unfair trade practices now prohibited by law, applicable to the processing, distribution, or handling of any commodity within this state, the director may include in any marketing order which is issued provisions that are designed to correct any trade practice which affects the processing, distributing, or handling of any commodity within this state which the director finds, after a hearing upon the marketing order in which all interested persons are given an opportunity to be heard, is unfair and detrimental to the effectuation of the declared purposes of this chapter.”

California Food and Agricultural Code Section 58890. The foregoing means that the parties to a marketing agreement or other similar arrangement can agree that certain conduct shall be deemed a violation of California law.

Taken as a whole, the members of the California Cantaloupe industry, who make up approximately 70% of the domestic Cantaloupe supply, are working together to accomplish two significant goals. See Leafy Green Marketing Agreement Article The first is to promote and ensure food safety, which is great! The second is to ensure that no one Cantaloupe grower is able to obtain a competitive price advantage over the other by electing not to incur the costs associated with a mandatory food safety program, which was reported to be approximately two cents per carton. This is a good idea!

The PACA prohibits certain types of conduct by fruit and vegetable buyers and sellers as unfair trade practices. Some examples of unfair trade practices include failing to make full payment promptly for produce purchases, misbranding or mislabeling of produce, making false and/or misleading statements in connection with produce transactions, and employing individuals under employment restrictions that were responsibly connected with a PACA violator firm. What you don’t see addressed here is the subject of food safety and the unfair advantages associated with non-compliance with food safety laws. Maybe it should… 70% of the Cantaloupe industry seems to think so!

But, what the PACA does give the suppliers of perishable agricultural commodities (“Produce”) is the right to obtain trust protection on the sums “owing in connection” with their transactions in produce. 7 U.S.C. 499e(c)(2). The cost of food safety (i.e. the two-cent per carton assessment discussed above) is a sum owning in connection with a company’s transactions in produce. The cost of compliance with food safety programs and laws help ensure the safety of the produce itself and that serves the public interest.

As such, the cost of food safety compliance should be considered an inseparable part of a company’s transactions in produce and it should be invoiced as such. Any company that has ever been on the wrong side of a foodborne illness issue or incurred the costs associated with a major recall can attest to the fact that the cost of prevention is far less than the alternative, which often includes brand identity damage, loss of goodwill in the marketplace and litigation costs. Moreover, as we see from the premiums placed on most organic products, consumers will seek out and pay for safer products.

FSMA: Comment Period Opened on Food Facility Information Collection Program

The Food and Drug Administration (FDA) recently announced an opportunity for public comment on the proposed collection of certain information by the Agency. This notice solicits comments on the information collection provisions of FDA’s program of voluntary submission of food facility profile information and the new Form FDA 3797, which may be submitted electronically via the FDA Industry Systems Website.

Under the Public Health Security and Bioterrorism Preparedness and Response Act of 2002 (Pub. L. 107-188) (the “Bioterrorism Act”) FDA was further authorized to improve the ability of the United States to prevent, prepare for, and respond to bioterrorism and other public health emergencies. The Bioterrorism Act added section 415 of the FD&C Act (21 U.S.C. 350d), which requires domestic and foreign facilities that manufacture, process, pack, or hold food for human or animal consumption in the United States to register with FDA. (emphasis added). FDA regulations at 21 CFR 1.230 through 1.235 set forth the procedures for registration of food (including animal food/feed) facilities.

The types of information the FDA proposes to collect in its voluntary food facility profile includes, among other things:

-

The facility type (i.e. manufacturer/processor, re-packer/packer, warehouse/holding facility)

-

The products and related hazards (i.e. biological, physical, chemical), along with preventive control measures associated with said products

-

Facility information (i.e. food safety training, facility size, number of employees, operational schedule, etc.)

With respect to the collection of information, FDA invites comments on the following topics: (1) whether the proposed collection of information is necessary for the proper performance of FDA’s functions, including whether the information will have practical utility; (2) the accuracy of FDA’s estimate of the burden of the proposed collection of information, including the validity of the methodology and assumptions used; (3) ways to enhance the quality, utility, and clarity of the information to be collected; and (4) ways to minimize the burden of the collection of information on respondents, including through the use of automated collection techniques, when appropriate, and other forms of information technology.

The deadline to submit either electronic or written comments on the collection of information summarized above is July 10, 2012. Please take full advantage of this opportunity. These rules will affect how the industry operates and establishs another key standards against which a food facility will be measured. As such, it is important to voice your concerns to the FDA during these comment periods.

Jason Klinowski Published in Food Safety Magazine

The May 2012 edition of Food Safety Magazine’s eDigest includes a 2012 Farm Bill Update Article that I co-authored along with John Shapiro.

The May 2012 edition of Food Safety Magazine’s eDigest includes a 2012 Farm Bill Update Article that I co-authored along with John Shapiro.

Please see a link to the article below:

Food Safety Magazine – eDigest

This article looks at the “2012 Farm Bill” and discusses the proposals heading to the Senate for consideration and debate.

Restrictive Endorsements: What you need to know about accord and satisfaction

Savvy credit managers need to understand how to use restrictive endorsements to their advantage and how to deal with any restricted check they may receive.

Savvy credit managers need to understand how to use restrictive endorsements to their advantage and how to deal with any restricted check they may receive.

As a matter of policy, a company should make it a practice not to deposit any check containing a restrictive endorsement until they have discussed the issue with their legal counsel.

With that said, here is an overview of what credit managers should know about accord and satisfaction:

To constitute a valid accord and satisfaction it is essential that what is given shall be offered in full satisfaction and extinction of the original debt. That the debtor shall intend it as a full satisfaction of the original debt and that such intention shall be made known to the creditor in some unmistakable manner.

It is equally important that the creditor shall have accepted it with the intention that it should operate as a full satisfaction of the original debt.

Generally, an accord and satisfaction requires:

-

a bona fide dispute, plus

-

tender which is clearly made as payment in full.

1 Am. Jur. Accord & Satisfaction, Section 22 et. seq. See also Louis Caric & Sons v. Ben Gatz Co., 38 Agric. Dec. 1486 (1979); Mendelson-Zeller Co. v. Michael J. Navilio, Inc., 34 Agric. Dec. 903 (1975); Kelman Farms v. Bushman Brokerage, 34 Agric. Dec. 1146 (1975); Mendelson-Zeller Co. v. The Season Produce Co., 31 Agric. Dec. 1288 (1972).

“To constitute an accord and satisfaction it is necessary that the money be offered in full satisfaction of the demand, and be accompanied by such acts and declarations as amount to a condition that the money, if accepted, is accepted in satisfaction; and it must be such that the party to whom it is offered is bound to understand therefrom that, if he takes it, he takes it subject to such conditions. The mere fact that the creditor receives less than the amount of his claim, with knowledge that the debtor claims to be indebted to him only to the extent of the payment made, does not necessarily establish an accord and satisfaction.”

Spada Distributors Co. v. Frank KenworthyCo., 17 Agric. Dec. 347 (1958). (emphasis added). Quoted in Mendelson-Zeller Co. v. The Season Produce Co., 31 Agric. Dec. 1288 (1972).

Clear and CONSPICUOUS terms required

Words: “This check is in settlement of the following invoices: . . .” and words: “This check is in settlement of the following. If incorrect please return.” did NOT constitute clearly conditional tender. Half Moon Fruit & Produce Co. v. North American Produce, 40 Agric. Dec. 1610 (1981) (emphasis added); Harvitz Brothers v. David Goldsamt, 20 Agric. Dec. 391 (1961).

Words: “Payment in Full” or “similar words” held effective. Kelman Farms v. Bushman Brokerage, 34 Agric. Dec. 1146 (1975) (emphasis added); Southmost Vegetable Co-Op v. M. & G. Tomato, 28 Agric. Dec. 966 (1969); Johnson & Allen v. Fernandez Bros., 27 Agric. Dec. 1127 (1968); Zinno v. Marvin, 24 Agric. Dec. 396 (1965); National Produce Distributors, Inc. v. Stewart Produce, 21 Agric. Dec. 955 (1962) [Transaction lacked bona fide dispute, and check was not offered in good faith where accord language was pre-printed on the check].

Where a partial payment check was tendered on the condition that it be accepted as payment in full, but debtor did not specify to what debt it was to be applied, and there were several open accounts at the time of tender, creditor was within its rights when it applied the payment to an open freight bill, and no accord and satisfaction of the produce debt was accomplished. Jody DeSomma d/b/a Impact Brokerage v. All World Farms, Inc., 61 Agric. Dec. 821 (2002).

Bona Fide Dispute Required!

One of the biggest misuses of restrictive endorsements arise from the mistaken belief that placing a restrictive endorsement on all checks as a matter of company policy provides some benefit if a unknowing recipient deposits a partial payment. NOT TRUE! There must be a bona fide or good faith dispute that the partial payment is intended to resolve. A “gotcha” move will not carry the day and will be resolved in the payee’s favor.

Although respondent’s partial payment checks stated that the checks were tendered as payment in full, it was found that no accord and satisfaction existed as to several transactions because respondent had not proven that a dispute existed between the parties as to such transactions. Eustis Fruit Company, Inc. v. The Auster Company, Inc., 51 Agric. Dec. 865 (1992). Where a Respondent presented evidence of a breach by the Complainant this was not enough to show that there had been a dispute. Richard Ruiz v. Pacific Sun Produce Co., 48 Agric. Dec. 1105 (1989).

Good Faith Tender As Full Payment Necessary

Debtor tendered payment in one check for six produce transactions. Four of the transactions were undisputed, and the check covered these transactions in their full amount. The remaining two transactions were disputed, and as to these the check tendered only partial payment. The creditor negotiated the check, and then sought to recover the balance alleged due on the disputed transactions. The debtor pled accord and satisfaction. It was held that the good faith tender requirement of UCC 3-311 would not be met by such a check, especially in view of the “full payment promptly” requirement of the Act and Regulations. Lindemann Produce, Inc. v. ABC Fresh Mktg., Inc., et al., 57 Agric. Dec. 7389 (1998).

In C. H. Robinson Company v.TrademarkProduce, Inc., 53 Agric. Dec. 1861 (1994) the words “Full and Final Payment” were pre-printed on all of respondent’s checks in very small type. Referencing Official Comment 4 to UCC Section 3-311 it was held that the requirement of “good faith tender” had not been met, and there was no accord and satisfaction.

Although respondent’s partial payment checks stated that the checks were tendered as payment in full, it was found that no accord and satisfaction existed as to one transaction because there was no manifested intent that the payment should apply to all the items on the invoice where respondent paid in full for one of the types of fruit. Eustis Fruit Company, Inc. v. The Auster Company, Inc., 51 Agric. Dec. 865 (1992).

Return the Check!

Under UCC Section 3-311 the return within 90 days of an amount paid in full satisfaction of a claim disputed in good faith precludes the discharge of the claim. Pacific Tomato Growers, LTD v. American Banana Co., Inc., 60 Agric. Dec. 352 (2001). Simply put, you must return the check containing a restrictive endorsement to the sender within 90 days of your receipt. If you keep it as a partial payment you will be deemed to have accepted full payment.

BEST PRACTICES

- If you use a lock box service to receive payments, consider notifying your bank in writing not to deposit any checks containing a restrictive endorsement. Instead, these checks should be forwarded directly to the company for assessment.

- If you place a restrictive endorsement on a check, use the correct terminology and make it CONSPICUOUS.

- Do not bundle or combine payment for both disputed and undisputed invoices. You may lose the benefit of the restrictive endorsement if there is not a bona fide dispute.

- Always reference the disputed invoice the check is intended to resolve.

- Be prepared to return the partial payment if you are not willing to accept it as full payment.

- Return the check in a timely manner and include a cover letter articulating your position.

- Don’t deposit checks containing a restrictive endorsement until you have assessed the situation.

Jason Klinowski Published in Food Safety Magazine

The April 2012 edition of Food Safety Magazine’s eDigest includes a Food Safety Modernization Act Update Article that I co-authored along with John Shapiro.

The April 2012 edition of Food Safety Magazine’s eDigest includes a Food Safety Modernization Act Update Article that I co-authored along with John Shapiro.

Please see a link to the article below:

Food Safety Magazine – FSMA Legislative Update

This article looks at the “FSMA One-Year Progress Report” and discusses where we are with the implementation of this historic act.